Simple Interest vs Compound Interest: Which is Better?

Simple Interest vs Compound Interest: Which is Better?

Blog Article

- Source: Image by Andrii Yalanskyi

Teacher: Hey, could you help me with one question? I keep hearing about Simple Interest vs Compound Interest. What’s the difference?

Student: Yes. Both are ways of calculating interest on your money, but they work very differently. Simple Interest is straightforward, while Compound Interest can make a big difference in the long run. Let me explain.

Teacher: That sounds interesting. Which one is better?

Student: Well, it depends on the situation. Simple Interest is easier to calculate and is usually used for short-term loans. On the other hand, Compound Interest can grow your money significantly over time, which is why it’s great for long-term investments.

Teacher: That makes sense. Can you break it down for me?

Student: Sure! Let’s start with Simple Interest.

Understanding Simple Interest vs Compound Interest

What is Simple Interest?

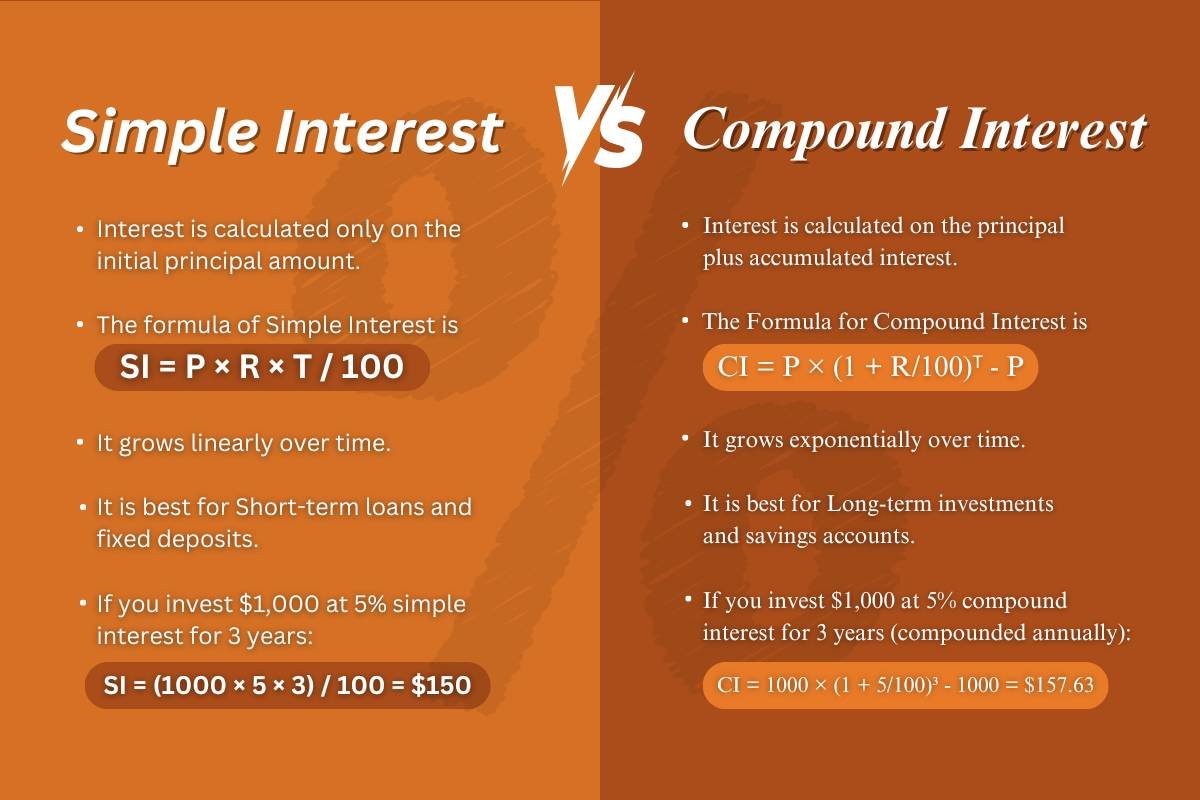

Simple Interest is a method of calculating interest where the amount you will earn remains constant over the years, starting from the original principal amount. Generally, it is used for short-term loans and fixed deposits. It is very simple and does not reinvest the profits earned from the interest. This means it is very simple, and there is no reinvesting of profits earned from interest factor-wise.

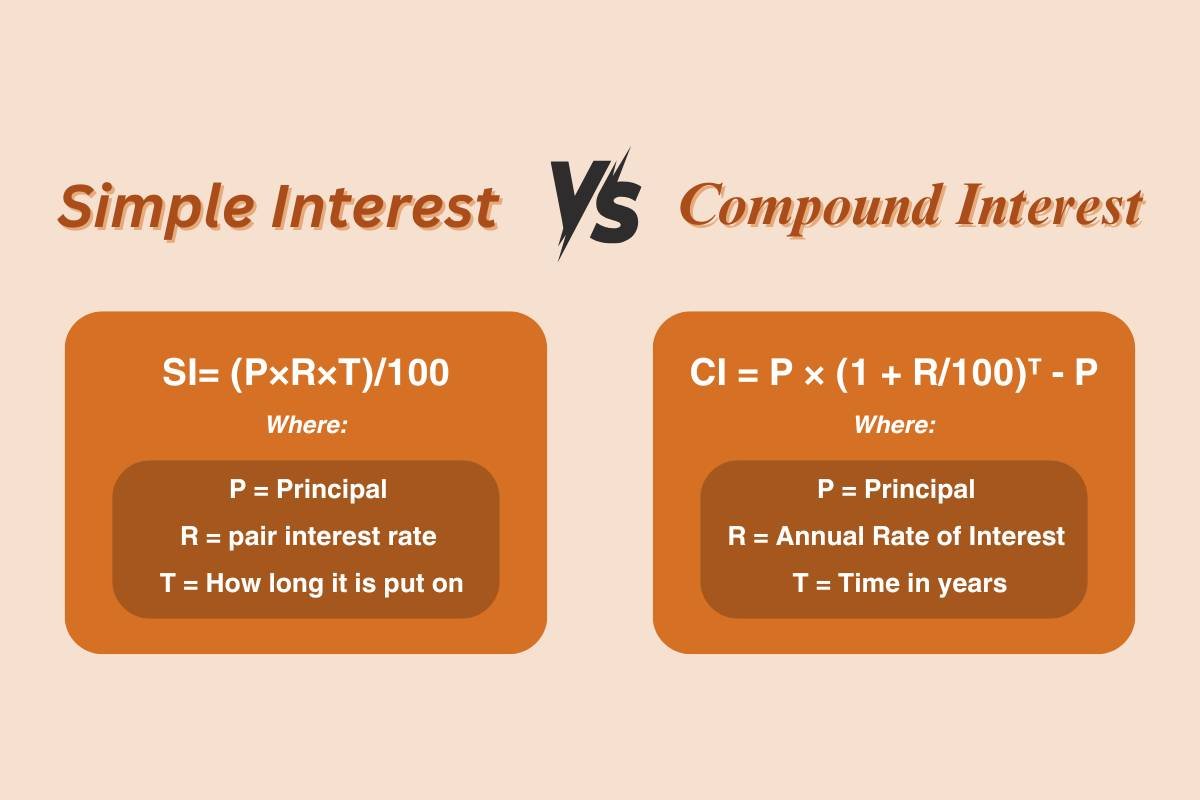

Simple Interest formula:

SI= (P×R×T)/100SI = (P times R times T) / 100

Where:

P=Principal, or initial amount invested or loaned;

R=pair interest rate, annual percentage;

and T= How long it is put on;

In this case, suppose you invested $1000 at a rate of interest of 5% per annum for 3 years. The amount of interest earned on this would work out to Therefore, the total amount left in that account after 3 years will work out to $1150.

Teacher: That’s pretty straightforward. So, if I keep my money in an account with Simple Interest, I will only earn a fixed amount of interest every year?

Student: Exactly! Now, let’s talk about Compound Interest.

What is Compound Interest?

When we talk about Compound Interest, it refers to the interest calculated on the principal as well as on the accumulated interest. This methoists better for long-term loans or investments. However, it can be quite complicated due to factors like the timeline for computing interest earned or paid upon a loan.

The formula for Compound Interest–

CI=P×(1+R/100)T−PCI = P times (1 + R/100)^T – P

Where:

A = the final amount that will be due

P = the principal (the amount of money invested or borrowed)

R = the annual interest rate expressed as a decimal

N = the number of times interest is applied per period (i.e., annually, monthly, daily, etc.)

Example of Compound Interest:

Consider $100 invested over 3 years where the interest rate of 5 percent compounds annually. Suppose the investment has been made in the bank. Therefore, at the end of year one, you’ll have $105. So in year two, you will be receiving interest on $105, not just $100. At the end of year two, you’ll have $110.25, and at the end of year three, you will end up with $115.76. Adding it all up, therefore, would give a final amount of $115.76. That’s Compound Interest! To clarify, it’s the same as saying, “I put my money to work!”

If, however, you are not satisfied with just this little piece of comparison, allow me to show you the other one before you finally decide which is better.

Two main things can be compared: interest earned on savings with compound interest and simple interest. To gain a better understanding, we will use scientific examples in this comparison. After all, it’s usually better to learn from an example rather than theoretical explanations.

Key Differences: Simple Interest vs Compound Interest

| Feature | Simple Interest | Compound Interest |

| Basis of Calculation | Principal amount only | Principal + Accumulated Interest |

| Growth Rate | Linear | Exponential |

| Returns | Lower over time | Higher over time |

| Common Uses | Personal loans, car loans | Savings accounts, investments, long-term loans |

Which One Should You Choose?

The implication of simple interest and compound interest comes in the context of actual scenarios: most fixed deposits give simple interest while savings accounts and recurring deposits use compound interest;

Simple interest is generally used in car loans and personal loans while compound interest is taken for home loans and education loans that increases the entire amount payable as a function of age; Stocks, mutual funds, and retirement accounts like 401(k) or IRA would be benefits in terms of compound, greatly increasing the wealth within decades.

Also read: Best Investment Apps for Beginners: A Comprehensive Guide

Final Thoughts

Simple Interest vs Compound Interest plays a vital part in finance. With Sure Interest, one can easily understand and have no difficulty with if conditions allow for only for short duration; whereas Compound Interest has that power to build annuity wealth over years of prudent investing. Well, understanding them does make a good deal of difference in judicious actions towards saving towards investment or taking a loan of certain kinds. Thanks so much, Alex! That clears my mind so much better. I will look for investment opportunities offering Compound Interest, allowing my money to earn for me over time.